CapitalConnector.ai: Revolutionizing Startup Fundraising

CapitalConnector.ai is an AI-driven platform designed to simplify startup fundraising. With a database of 75,000+ angels, venture capitalists (VCs), and advisors, it empowers entrepreneurs to connect with the right investors effortlessly.

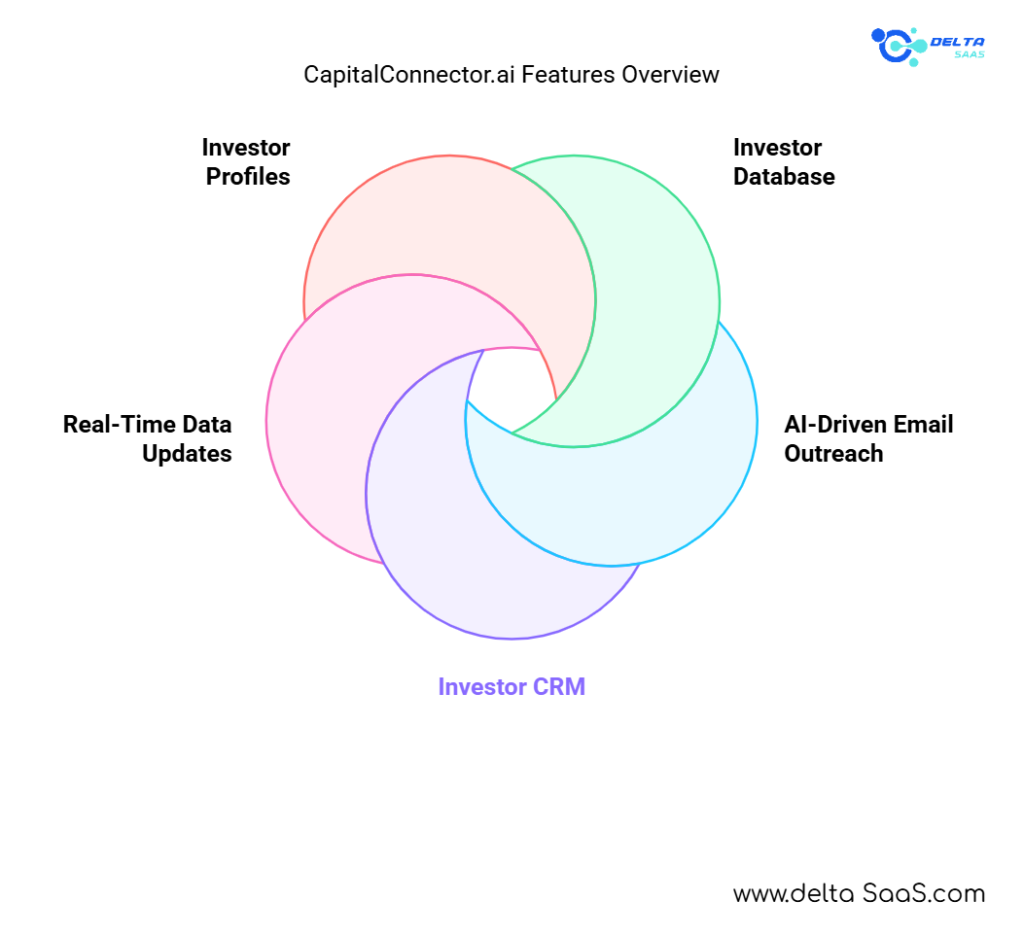

Key Features of CapitalConnector.ai

Comprehensive Database

CapitalConnector.ai gives users access to a vast repository of 75,000+ verified contacts. These include angel investors, VCs, advisors, and accelerators. Each entry includes critical details such as:

- Verified Emails

- Investment Preferences

- Social Media Links

This robust database saves startups the effort of manually sourcing investors.

AI-Generated Emails

The platform uses AI to generate personalized emails. These are optimized based on successful funding pitches, increasing the chance of attracting an investor.

Advanced Filters

Search tools allow startups to filter by location, past investments, and preferred funding amounts. This ensures that startups find investors who align perfectly with their goals.

Investor CRM

CapitalConnector.ai includes a basic CRM system for:

- Tracking Communication

- Scheduling Calls

- Monitoring the Progress of Deals

This feature centralizes investor relationship management.

Export Options

All data can be exported into CSV format. This is especially useful for integrating with tools like Excel, QuickBooks Online, and other ERP systems for custom accounting.

If you’re looking for the best software, check out Delta SaaS, which offers discounts and lifetime deals on SaaS products.

Pricing Plans of CapitalConnector.ai

CapitalConnector.ai offers transparent pricing with two-lifetime access plans:

| Plan | Cost | Features |

| Plan 1 | $49 | Unlocks 500 contacts/month, AI emails, and CSV export |

| Plan 2 | $98 | Unlimited contacts per month and all features in Plan 1 |

Both plans include a 60-day money-back guarantee, making it risk-free to try.

Benefits of Using CapitalConnector.ai

Time-Saving Solution

Instead of spending hours compiling investor lists, startups can access ready-to-use contacts.

Strategic Fundraising

Tailored searches help startups identify investors with relevant funding histories.

Enhanced Email Effectiveness

AI-driven emails are tailored to boost response rates, making initial outreach more impactful.

Simplified Management

Its CRM-like capabilities eliminate the need for external tools, ensuring organized workflows.

Drawbacks to Consider

While CapitalConnector.ai excels in many areas, it has minor limitations:

- Interface Usability: Some users report a steep learning curve for new users.

- AI Customization: Generated emails lack deeper personalization for niche industries.

- Data Updates: Investor details, though verified, may occasionally need external confirmation.

How CapitalConnector.ai Supports Startups

Perfect Fit for Small Businesses and Solopreneurs

CapitalConnector.ai is tailored to small businesses and solopreneurs seeking scale. Its user-friendly dashboard integrates seamlessly with tools like Excel and QuickBooks Online, helping businesses organize their investor outreach.

Facilitates Confidence in Fundraising

Startups can confidently pitch to investors, knowing that accurate and comprehensive data backs them. The AI-powered email personalization adds a professional touch, ensuring communications leave a lasting impression.

Simplifies Financial Reporting

CapitalConnector.ai’s export functionality allows startups to integrate investor data with financial reporting tools like:

- QuickBooks Online

- Xero

- Sage

- Custom Accounting Solutions

This integration helps generate balance sheets, income statements, and trial balances, which are critical for investor discussions.

Accelerates the Funding Cycle

By providing detailed investor insights, CapitalConnector.ai helps startups approach the right contacts. This reduces the time spent on cold emailing and increases the likelihood of securing funding.

Who Can Benefit Most?

Startups Seeking Angel Investors or VCs

CapitalConnector.ai bridges the gap between startups and investors, whether they’re looking for seed funding, series A, or beyond.

Advisors and Accelerators

Advisors and accelerators can use the platform to identify partners and expand their networks.

AI-Driven Tools Enthusiasts

Tech-savvy users appreciate the platform’s AI-driven features, especially for creating investor-ready strategies.

Pros and Cons of CapitalConnector.ai

Pros

- Extensive Investor Database: Covers various angels, VCs, and advisors.

- Affordable Pricing: One-time fee models make it budget-friendly.

- Export Options: CSV exports are compatible with various accounting and ERP systems.

- AI Integration: Streamlines communication with personalized emails.

Cons

- Limited Customization: Emails lack advanced tweaks for niche industries.

- Data Accuracy Challenges: Some information may need independent verification.

- Learning Curve: The user interface could be more intuitive for new users.

Comparison With Competitors

CapitalConnector.ai competes with platforms like Raizer and Product Hunt. Here’s how it stands out:

| Feature | CapitalConnector.ai | Raizer | Product Hunt |

| AI-Generated Emails | Yes | No | No |

| Lifetime Access Pricing | Yes | Subscription-based | Free but limited |

| Investor Database Size | 75,000+ contacts | Smaller Database | Not focused on investors |

| Export Functionality | CSV format available | No | No |

CapitalConnector.ai shines with its affordability, AI-driven tools, and significant investor database.

Genuine Customer Reviews of CapitalConnector.ai

Positive Feedback

- “Saved me countless hours searching for angel investors.” – Startup Founder.

- “The personalized email templates worked great; I received three positive replies in a week.” – Early-Stage Entrepreneur.

Constructive Criticism

- “The interface could use some improvements for easier navigation.” – Small Business Owner.r

- “I wish the email templates had more industry-specific options.” – VC Consultant.

Who Should Use CapitalConnector.ai?

CapitalConnector.ai is ideal for:

- Entrepreneurs are starting their first funding rounds.

- Small businesses seeking affordable tools to scale.

- Advisors looking to expand their professional networks.

CapitalConnector.ai: A Practical Guide for Fundraising Success

Steps to Get Started

- Create an Account Signing up is straightforward, with no technical expertise required. Users can start exploring the platform within minutes.

- Set Your Search Filters Customize your search using criteria like location, funding preferences, and industry focus. This ensures a targeted approach to finding suitable investors.

- Unlock Investor Contacts: Users can access up to 500 or unlimited contacts monthly, depending on the chosen plan. You can export these contacts for seamless integration with existing tools.

- Generate Personalized Emails Leverage the AI-driven email tool to craft professional introductions. Modify the generated content for an extra layer of personalization.

- Track and Manage Progress Use the built-in CRM to log interactions, set reminders, and monitor responses. This keeps outreach efforts well-organized.

Why Choose CapitalConnector.ai Over Manual Methods?

Time and Resource Efficiency

Traditional fundraising often involves hours of research and cold outreach. CapitalConnector.ai eliminates this by providing curated, verified data and automated email templates.

Professionalism at Scale

Even with limited resources, startups can project professionalism through AI-generated communications and well-organized investor tracking.

Cost-Effective Solution

With its lifetime deal, CapitalConnector.ai is more affordable than recurring subscription-based platforms. For $49 or $98, users gain ongoing access to valuable tools.

CapitalConnector.ai in Numbers

- 75,000+ Verified Contacts: Includes angels, VCs, and advisors.

- 2 Pricing Plans: Starting at $49 for lifetime access.

- 60-Day Refund Policy: Risk-free for users.

- 500 Contacts/Month Unlock (Plan 1): Ideal for small-scale campaigns.

- Unlimited Contacts (Plan 2): Suitable for startups scaling outreach.

Everyday Use Cases of CapitalConnector.ai

Building Investor Lists for Specific Niches

Startups targeting niche markets, like SaaS or healthcare, can filter investors by past investments in these sectors.

Scaling Outreach for Growth

Companies looking to expand rapidly benefit from the unlimited contact unlock feature, especially in Plan 2.

Streamlining Investor Follow-Ups

Using CRM ensures startups can track replies, avoid duplicate emails, and maintain professionalism.

Also Read

Financial Fusion Reviews: AI-Powered CFO for Clear Financial Insights

Flightpath Finance Reviews: Features, Pricing, and Benefits

Fox Signals Reviews: Revolutionizing Cryptocurrency Trading with AI

HypeIndex AI Reviews: Trend Analysis Simplified

Conclusion

CapitalConnector.ai is a valuable tool for startups and small businesses aiming to navigate the challenging fundraising landscape. With a vast investor database, AI-driven outreach, and user-friendly features, it simplifies connecting with the right investors. While there are areas for improvement, such as interface usability and deeper email customization, its affordability and functionality make it a top choice for entrepreneurs.

FAQs About CapitalConnector.ai

What is CapitalConnector.ai?

CapitalConnector.ai is an AI-powered platform connecting startups with 75,000+ investors, including angels and VCs.

How much does CapitalConnector.ai cost?

It offers two lifetime plans: $49 for 500 contacts/month or $98 for unlimited contacts.

Does it generate personalized emails?

Yes, it uses AI to craft emails optimized for investor outreach.

Who can benefit from CapitalConnector.ai?

Startups, solopreneurs, advisors, and accelerators can all benefit from its features.

Is there a refund policy?

Yes, users have a 60-day money-back guarantee.

Can I export data?

Yes, contacts can be exported in CSV format for further use.

How accurate is the investor data?

The platform provides verified data but encourages users to cross-check.

Does it integrate with accounting tools?

Data exports can be used with tools like Excel, QuickBooks Online, and Xero.

Are there any usage limitations?

Planone1 limits contact unlocks to 500/month, while Plan 2 offers unlimited access.

Is CapitalConnector.ai beginner-friendly?

Yes, though some users may find the interface requires minor acclimatization.