Flightpath Finance Lifetime Deal: Comprehensive Financial Modeling for SaaS

Flightpath Finance is a specialized financial modeling software built for SaaS companies. It provides tools to simplify complex financial forecasting, ensuring businesses can predict cash flow, monitor key metrics, and make informed decisions.

Whether you’re a small business owner, a financial planner, or a SaaS leader, Flightpath Finance helps streamline financial workflows.

Why Choose Flightpath Finance?

- Real-Time Integration: Syncs with tools like QuickBooks Online and Xero.

- Scenario Forecasting: Build and compare multiple financial scenarios for better insights.

- Custom Dashboards: Create visual representations of data, including income statements and balance sheets.

- Automation: Reduces manual forecasting with autopilot features.

- Tailored for SaaS: Focuses on subscription-based revenue models, cash flow, and SaaS KPIs.

Key Features of Flightpath Finance

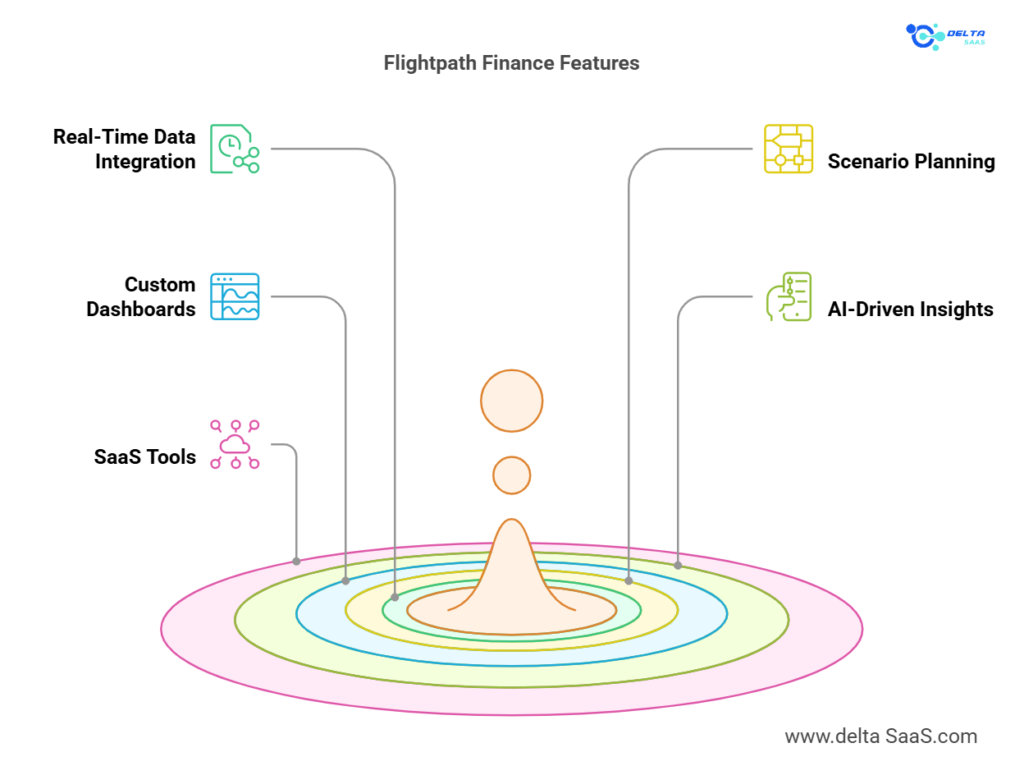

Real-Time Data Integration

Flightpath Finance connects with accounting platforms like QuickBooks Online, Xero, and other ERP systems. This ensures that your forecasts are always up to date with the latest data, removing the need for manual updates.

- Supported Tools: Xero, Sage, SAP, and QuickBooks Online.

- Data Synchronization: Automates imports for accuracy in income statements and balance sheets.

Scenario Planning and Forecasting

Model different scenarios such as hiring plans, revenue growth, and operating expenses. Predict and compare how changes affect profitability and cash flow.

- Adjustable Parameters: Create forecasts for tax, payroll, and employee expenses.

- Scenario Comparison: Analyze multiple models side by side for strategic decision-making.

Custom Dashboards

Visualize key financial metrics in an aesthetic and organized dashboard. Monitor KPIs, track progress, and review critical data points like trial balances and revenue forecasts.

- Features: Drag-and-drop templates for dashboards.

- Personalization: Highlight your most important metrics.

Automation and AI-Driven Insights

Use autopilot forecasting to generate predictions based on historical trends. Eliminate manual adjustments to save time and focus on strategic planning.

- AI-Powered Predictions: Automates expense forecasting.

- Efficiency: Reduces dependency on spreadsheets like Excel.

Industry-Specific Tools for SaaS

SaaS businesses often face unique financial challenges. Flightpath Finance addresses these with tailored tools:

- Subscription Revenue Tracking: Monitor recurring revenue streams.

- Churn Analysis: Understand customer retention and its financial impact.

- Hiring Plan: Forecast salary costs and payroll cycles.

If you’re looking for the best software, check out Delta SaaS, which offers discounts and lifetime deals on SaaS products.

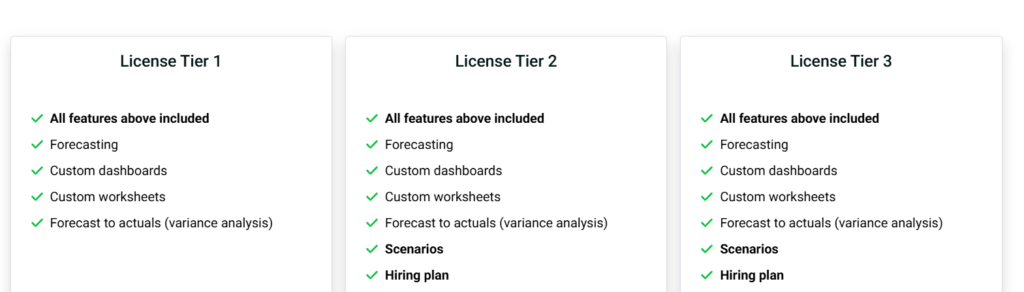

Pricing Plans

Flightpath Finance offers subscription tiers that suit businesses of different sizes.

| Plan | Target Revenue | Price (Monthly) | Onboarding Fee |

| Startup Plan | Up to $5M ARR | $1,000 | $3,000 |

| Growth Plan | Up to $10M ARR | $2,000 | $3,000 |

- Lifetime Deal: Contact Flightpath Finance for custom deals.

Benefits of Flightpath Finance

Time-Saving Automation

It reduces manual efforts, allowing accountants and financial managers to focus on strategic decisions.

Accuracy and Insights

Scenario planning and real-time updates ensure precise forecasts.

SaaS-Specific Customization

Handles subscription revenue models, churn rates, and ARR calculations.

Seamless Integration

Compatible with ERP systems and bookkeeping tools like Sage, SAP, and Xero.

Limitations

Cost

High pricing may deter startups with limited budgets.

Learning Curve

New users may require training to leverage their full potential.

Pros and Cons of Flightpath Finance

Pros

- Robust Financial Modeling: Flightpath Finance simplifies complex financial forecasts for SaaS businesses, helping them visualize key financial metrics and automate predictions.

- Seamless Integration: Works with major accounting software like QuickBooks Online, Xero, and other ERP tools.

- Scenario Flexibility: Supports multi-scenario planning for financial forecasting.

- Automation: Reduces repetitive tasks, saving time for accountants and managers.

- SaaS-Specific Features: Seamlessly handles recurring revenue, churn analysis, and ARR growth.

Cons

- Price Point: The subscription model, especially with the onboarding fee, can be expensive for small businesses.

- Complex Setup: Some users report that the initial configuration and learning curve can only be challenging with professional guidance.

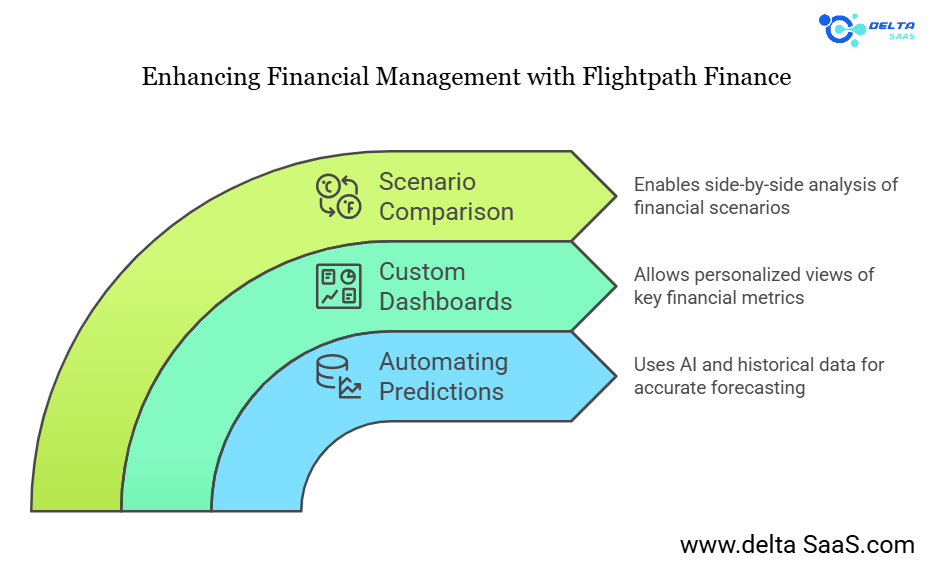

How Flightpath Finance Enhances Financial Forecasting

Automating Predictions

Using historical data and AI, Flightpath Finance automates expense and revenue forecasting. This feature benefits businesses by delivering precise estimates with minimal manual intervention.

Custom Dashboards for Financial Monitoring

Users can design personalized dashboards to view metrics such as cash flow, income statements, and tax calculations.

- Example Metrics: Monthly revenue growth, payroll cycle costs, and balance sheets.

- Dashboards for Teams: Share reports with accounting departments for collaboration.

Scenario Comparison for Better Decisions

Flightpath Finance allows users to compare different financial scenarios side-by-side. This feature is handy for SaaS companies planning product launches or workforce expansions.

- Scenario Planning Example:

- Model 1: 10% revenue growth with no hiring.

- Model 2: 20% revenue growth with a 15% increase in operational costs.

The software calculates the long-term impact of these scenarios on cash flow and profitability.

Customer Reviews of Flightpath Finance

Customer feedback highlights the strengths and areas for improvement of the software.

Positive Reviews

- Ease of Use: Users appreciate its intuitive interface and customizable dashboards.

- Accurate Forecasting: Customers report higher confidence in their financial models.

- Customer Support: Flightpath Finance offers responsive support, ensuring smooth onboarding.

Negative Reviews

- Pricing Concerns: Startups with limited funds find the cost restrictive.

- Integration Challenges: A few users mention minor difficulties syncing data with specific ERP systems.

Use Cases for Flightpath Finance

- Startups: Visualize early-stage financial metrics and set achievable goals.

- Established SaaS Companies: Model long-term growth scenarios and evaluate the impact of scaling up operations.

- Accounting Departments: Streamline processes like payroll management, tax calculations, and trial balances.

Why Flightpath Finance is Ideal for SaaS Businesses

Flightpath Finance stands out because it caters specifically to the needs of SaaS companies. Its ability to handle subscription revenue, track customer churn, and forecast recurring income sets it apart from traditional accounting tools.

Key SaaS-Specific Features

Subscription Revenue Tracking

Flightpath Finance accurately tracks Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR).

- MRR Growth Analysis: Forecast how subscription rate or pricing plan changes affect revenue.

- Churn Monitoring: Evaluate customer retention to plan better acquisition strategies.

SaaS KPIs

Monitor metrics like Lifetime Value (LTV), Customer Acquisition Cost (CAC), and revenue retention.

- Visualized Data: Dashboards present these KPIs clearly for quick insights.

- Scenario Planning: Assess how pricing model changes impact CAC or LTV.

How Accountants and Small Businesses Benefit

Simplified Bookkeeping

Small businesses and accountants can save hours by automating routine bookkeeping tasks.

- Integrated Accounting Software: Directly syncs with tools like Sage and Intuit QuickBooks.

- Payroll and Tax: Automates payroll cycles and generates tax-ready financial reports.

Collaborative Financial Planning

With customizable dashboards and shared access, Flightpath Finance supports collaboration among accounting managers and departments.

- Templates: Pre-built templates for income statements, trial balances, and tax calculations.

- Report Sharing: Send visualized reports to stakeholders with ease.

Flightpath Finance Lifetime Deal

The Flightpath Finance Lifetime Deal offers incredible value for SaaS companies seeking long-term solutions for financial modeling and forecasting. While details about lifetime access pricing may vary, contacting Flightpath’s sales team can unlock tailored options.

Why Consider a Lifetime Deal?

- Cost-Effective: Pay once and avoid recurring subscription fees.

- Scalability: Lifetime access ensures that the software grows with your business.

- Value for SaaS Companies: Comprehensive features, such as scenario planning, autopilot forecasting, and SaaS KPI tracking, are included.

How to Implement Flightpath Finance

- Professional Onboarding:

Flightpath Finance provides an onboarding service to help companies integrate the tool into their existing workflows. - Data Integration:

Connect accounting systems like Xero, QuickBooks, or Sage to import historical data seamlessly. - Dashboard Customization:

Build visual dashboards tailored to your business’s key financial goals. - Scenario Planning:

Use the forecasting tool to create various scenarios, enabling proactive decision-making. - Ongoing Support:

Utilize Flightpath’s customer support and resources to maximize the software’s potential.

Also Read

Sterling Stock Picker Lifetime Deal: Simplify Stock Picking

Fox Signals Lifetime Deal: Smarter Forex Tools

HypeIndex AI Lifetime Deal: Instant Stock Insights & Analysis

Conclusion

Flightpath Finance offers a game-changing financial modeling solution tailored for SaaS businesses. Its integration with popular accounting tools, advanced forecasting features, and SaaS-specific insights make it an essential software for managing and optimizing finances.

While its cost may concern smaller startups, the efficiency and accuracy it brings to financial planning often outweigh the investment. SaaS companies seeking to grow sustainably should strongly consider Flightpath Finance and inquire about its Lifetime Deal for maximum value.

FAQs

What is Flightpath Finance Lifetime Deal?

A one-time purchase option for lifetime access to Flightpath Finance’s financial modeling tools.

Does Flightpath Finance integrate with QuickBooks?

Yes, it supports QuickBooks Online, Xero, and other accounting software.

What features make Flightpath Finance SaaS-friendly?

It tracks MRR, ARR, churn, CAC, and LTV, essential metrics for SaaS companies.

Is Flightpath Finance suitable for small businesses?

Yes, but its pricing may be more suited for businesses with higher revenues.

Can I automate financial forecasting with Flightpath Finance?

Yes, autopilot forecasting automates predictions using historical data.

What’s the onboarding process like?

Flightpath Finance provides professional onboarding to integrate the tool smoothly.

Does it offer scenario planning?

Yes, you can model multiple financial scenarios to plan for the future.

How does Flightpath Finance handle payroll forecasting?

It includes tools to predict payroll cycles, employee expenses, and benefits costs.

Is there a free trial available?

Free trial details are not mentioned; contacting the sales team is recommended.

What support options are available?

Flightpath Finance provides customer support to address integration and usage issues.