Flightpath Finance Reviews: Features, Pricing, and Benefits

Financial modeling is crucial for SaaS companies to plan their growth. Flightpath Finance offers robust tools to help businesses understand their financial data and forecast accurately. This guide will review its features, pricing, advantages, and challenges.

Understanding Flightpath Finance

Flightpath Finance is financial modeling software designed for SaaS businesses. It provides detailed forecasts, revenue analysis, and cash flow management. Integrated with accounting tools like QuickBooks Online and Xero, it helps companies easily predict financial trends.

Key Features

- Real-Time Data Integration

- Syncs seamlessly with tools like QuickBooks Online, Xero, and Sage.

- Automatically updates data for accurate financial forecasting.

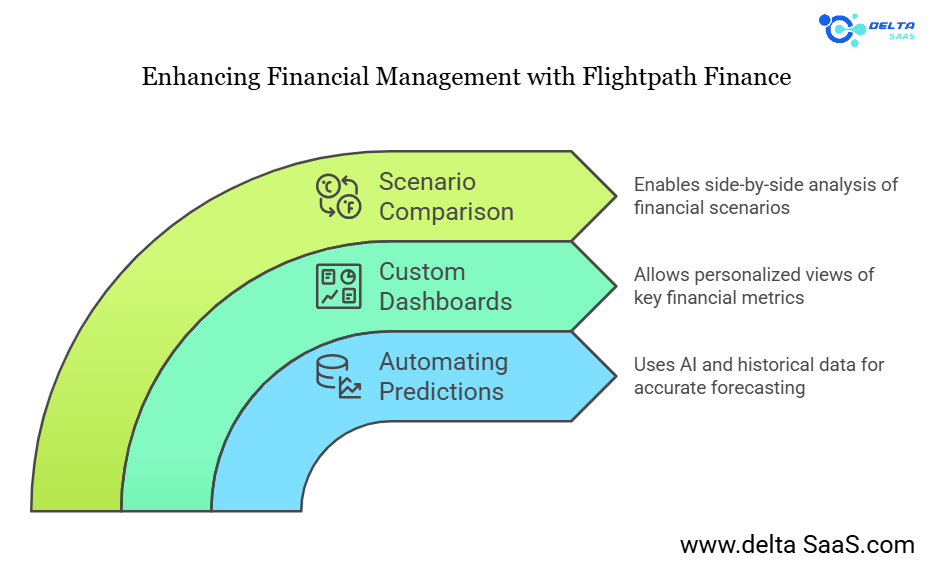

- Custom Dashboards

- Design personalized dashboards to track revenue, expenses, and KPIs.

- Enhance visibility into key financial metrics.

- Scenario Modeling

- Build multiple financial scenarios to test different strategies.

- Plan for revenue fluctuations, hiring costs, and investment opportunities.

- Forecast Automation

- Generates predictive insights using historical data.

- Saves time by reducing manual calculations.

- Team Collaboration

- Share financial models with team members or accountants.

- Work collaboratively for accurate planning.

If you’re looking for the best software, check out Delta SaaS, which offers discounts and lifetime deals on SaaS products.

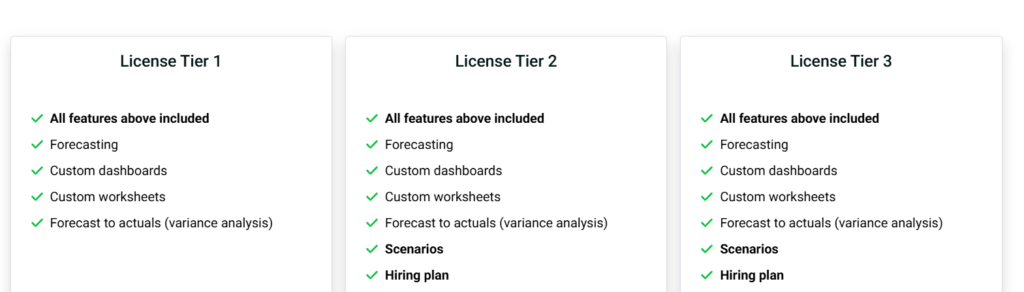

Pricing Plans

Flightpath Finance offers pricing tiers based on your business’s ARR (Annual Recurring Revenue).

| Plan Name | Suitable For | Pricing | Features |

| Startup | ARR up to $5M | $1,000/month | Essential forecasting, onboarding support |

| Growth | ARR up to $10M | $2,000/month | Advanced tools, team collaboration |

| Scale | ARR above $10M | Custom Pricing | Comprehensive solutions, premium support |

- Onboarding Fee: $3,000 for all plans to ensure smooth setup.

Comparing Competitors

Flightpath Finance excels in offering tailored features for SaaS companies. Competitors like Sage, Xero, and QuickBooks focus more on general accounting. While these tools are reliable, they may need advanced scenario modeling, which is Flightpath’s strength.

Advantages of Using Flightpath Finance

Advantages of Using Flightpath Finance

- Improved Accuracy

By automating forecasts, businesses reduce errors from manual calculations. - Custom Solutions

Features like scenario modeling and dashboards cater to SaaS-specific needs. - Saves Time

Integration with tools like Excel and QuickBooks Online streamlines processes. - Better Decision-Making

Real-time insights into key metrics help businesses pivot strategies effectively. - Scalable for Growth

Plans grow with your business, ensuring long-term utility.

Challenges

- Learning Curve

New users may need guidance to leverage all features. - Cost Consideration

The onboarding fee can be a hurdle for small businesses. - Limited Reviews

Few customer testimonials make it hard to evaluate long-term performance. - Overlapping Features

Some functions may overlap with existing accounting tools.

Customer Feedback

While official reviews for Flightpath Finance are limited, early adopters praise its ability to visualize and forecast key metrics. Many users highlight its seamless integration with accounting tools and intuitive dashboards.

Why SaaS Companies Choose Flightpath Finance

SaaS businesses operate in a dynamic environment where financial visibility is essential. Flightpath Finance equips them with tools to manage unpredictable cash flows, monitor revenue streams, and optimize operational costs.

Core Benefits

-

Tailored for SaaS Business Models

- Forecasts subscription-based revenue with precision.

- Accounts for recurring billing cycles, churn rates, and customer acquisition costs.

-

Comprehensive Financial Models

- Build detailed models covering balance sheets, income statements, and cash flow projections.

- Uses historical data to refine predictions.

-

Scalable Infrastructure

- Adapts to growing businesses, accommodating increasing revenue and expenses.

- Offers flexibility to handle enterprise-level data.

-

Effortless Collaboration

- It is ideal for cross-departmental use, connecting finance teams with marketing, sales, and operations.

Unique Selling Points

- Scenario Comparisons enable businesses to analyze “what if” situations, such as introducing new pricing models or hiring strategies.

- KPI Tracking: This monitors key SaaS metrics such as MRR (Monthly Recurring Revenue), ARR, and customer lifetime value.

- Integration: Pairs seamlessly with other accounting and ERP software like SAP and Xero.

Features in Depth

- Multi-Scenario Planning

Flightpath Finance allows businesses to simulate financial outcomes for multiple scenarios. For example:

- Scenario A: A 20% increase in marketing spend.

- Scenario B: Hiring five additional team members.

- Scenario C: Raising subscription prices by 10%.

These tools empower decision-makers to evaluate strategies before implementing them.

- Automated Insights

By using AI and machine learning, the software generates insights that save time and enhance accuracy. Companies no longer need to rely solely on manual spreadsheet calculations. - Expense Tracking

The software tracks and categorizes expenses automatically. Users can visualize trends and manage budgets effectively. - Real-Time Adjustments

Businesses can quickly modify financial assumptions, ensuring their models reflect current conditions.

Integration with Accounting Platforms

Flightpath Finance integrates with several popular accounting tools, making it easy to incorporate into existing workflows.

- QuickBooks Online:

Syncs financial data automatically for up-to-date insights. - Xero:

Allows seamless connection with general ledger and tax preparation modules. - Excel:

It offers compatibility for importing and exporting data, which is ideal for users transitioning from spreadsheets. - ERP Systems:

Works with tools like SAP for enterprise resource planning, providing a unified financial overview.

Comparison with Similar Tools

| Feature | Flightpath Finance | QuickBooks Online | Xero | SAP |

| Scenario Planning | Yes | Limited | Limited | Yes |

| Integration with SaaS | Advanced | Basic | Basic | Enterprise-Level |

| Automated Insights | Yes | No | No | Yes |

| Cost | Higher | Moderate | Moderate | Very High |

Flightpath Finance excels in advanced forecasting capabilities explicitly tailored to SaaS businesses.

Pros and Cons

Pros

- Advanced Forecasting: Ideal for SaaS-specific needs.

- Intuitive Dashboards: Simplifies tracking of key performance indicators.

- Strong Integration: Pairs well with major accounting platforms.

Cons

- Premium Pricing: More expensive than general accounting tools.

- Requires Training: It may take time to utilize all features.

- Limited Market Reviews: Fewer customer testimonials compared to established brands.

How Flightpath Finance Enhances Financial Planning

Accurate financial planning is critical for SaaS companies. Flightpath Finance combines automation, integration, and robust analytics to provide actionable insights that empower decision-making.

Key Advantages in Financial Planning

- Cash Flow Management

- Tracks inflows and outflows in real-time.

- Highlights cash runway to prepare for funding or expense adjustments.

- Revenue Forecasting

- Predicts MRR and ARR with tools tailored for subscription-based models.

- Accounts for variables like churn rate and customer acquisition costs.

- Expense Optimization

- Identifies unnecessary expenses.

- Offers insights into operational efficiencies.

- Goal Tracking

- Aligns financial forecasts with company growth objectives.

- Monitors progress toward revenue milestones or funding targets.

Flightpath Finance for Small Businesses

While Flightpath Finance primarily serves SaaS companies, small businesses, especially those seeking detailed forecasting capabilities, can also benefit.

Benefits for Small Businesses

- Ease of Use

Simplified dashboards allow small business owners to analyze financial data without extensive training. - Integration with Existing Tools

Syncs with popular accounting software like QuickBooks and Xero, minimizing the need for manual data entry. - Customizable Reports

Generates income statements, balance sheets, and cash flow reports tailored to business needs.

Comparison with Free Tools

Free accounting software like Wave and Zoho Books offers basic functionality but needs advanced forecasting and scenario analysis. Investing in such a solution ensures scalability and financial clarity for growing small businesses.

Customer Reviews

Positive Feedback

- Efficient Financial Planning

Customers appreciate the ability to generate detailed forecasts quickly.- “Flightpath made it easier to plan for hiring and revenue goals.”

- Time-Saving Integrations

Many users highlight seamless syncing with QuickBooks and Xero.- “No more manual entries—Flightpath updates everything in real-time.”

- SaaS-Specific Features

Businesses in SaaS models value the platform’s focus on MRR and ARR forecasting.- “Finally, a tool that understands SaaS metrics.”

Areas for Improvement

- Pricing Concerns

Some users find the cost high compared to competitors.- “Great tool, but the onboarding fee is steep for smaller teams.”

- Learning Curve

New users often need time to familiarize themselves with advanced features.- “It’s powerful but takes some effort to master.”

Flightpath Finance: Best Use Cases

- SaaS Startups

Perfect for startups needing to plan cash flow and growth strategies. - Mid-Sized Businesses

Useful for businesses managing multiple revenue streams and larger teams. - Consultants and Accountants

Ideal for professionals offering financial planning services to SaaS companies.

👉Flightpath Finance Lifetime Access!

Also Read

Fox Signals Reviews: Revolutionizing Cryptocurrency Trading with AI

HypeIndex AI Reviews: Trend Analysis Simplified

Final Thoughts

Flightpath Finance is a powerful tool for SaaS companies and businesses that prioritizes detailed financial modeling. Its unique combination of automation, integration, and forecasting ensures businesses can make informed decisions and prepare for future growth.

While it has a higher cost, its accuracy and time savings value make it a worthwhile investment in serious financial planning.

FAQs

What is Flightpath Finance?

A financial modeling software tailored for SaaS companies to forecast cash flow and revenue.

How does it help SaaS businesses?

It offers MRR, ARR forecasting, expense tracking, and scenario planning tools.

Which accounting platforms integrate with it?

QuickBooks Online, Xero, and Sage.

Is it suitable for small businesses?

Yes, but the onboarding cost may be a consideration for smaller budgets.

What is the starting price?

$1,000 per month, plus a $3,000 one-time onboarding fee.

Can it replace accounting software?

No, it complements existing tools by adding advanced financial forecasting.

What are the main SaaS-specific features?

Scenario planning, MRR/ARR tracking, and cash flow forecasting.

Does it offer a free trial?

No free trial is mentioned on the official website.

What are the challenges of using it?

High pricing and a learning curve for new users.

Who can benefit most from Flightpath Finance?

SaaS startups, mid-sized businesses, and financial consultants.