Simplify Your Invoicing Tasks with Invoiless: All-in-One Solution

Managing invoices can be a hassle, especially for small businesses, freelancers, and startups. Invoiless offers an innovative, all-in-one invoicing platform designed to make invoicing faster, easier, and more professional. Let’s examine what makes Invoiless a preferred choice and analyze its features, pricing, pros and cons, and user reviews.

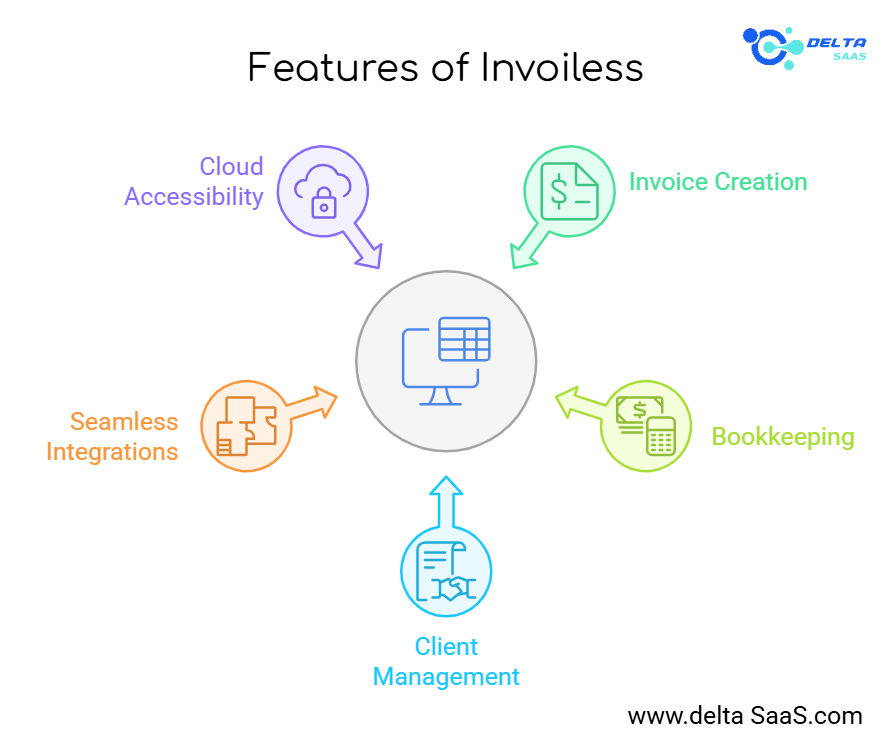

Key Features of Invoiless

Invoiless provides an extensive suite of tools to streamline the invoicing process.

Intuitive Dashboard

The platform features a simple, user-friendly dashboard. Users can track pending payments, completed invoices, and client information all in one place. This visual overview saves time and ensures financial clarity.

Customizable Invoice Templates

Invoiless offers responsive, professional templates that can be customized with your logo, colors, and payment terms. This feature ensures your invoices look consistent with your brand.

Automated Payment Tracking

With real-time tracking, Invoiless helps users monitor payment statuses, set reminders, and send follow-ups automatically. This reduces manual follow-ups and ensures faster payments.

Seamless API Integration

Invoiless supports integration with external systems like CRMs, accounting software, and websites. Developers can use the platform’s API to connect invoicing with tools like QuickBooks, SAP, and Xero.

Client Collaboration Tools

Clients can access invoices and communicate directly within the invoice page. This ensures that queries are resolved quickly and transparently.

Multi-currency and Payment Options

Invoiless supports payments in multiple currencies and integrates with popular gateways like PayPal, Stripe, and bank transfers. This flexibility benefits businesses dealing with international clients.

Mobile Accessibility

Upcoming mobile apps for iOS and Android allow users to manage invoices anytime, anywhere, ensuring uninterrupted workflows.

If you’re looking for the best software, check out Delta SaaS, which offers discounts and lifetime deals on SaaS products.

Benefits of Using Invoiless

Adopting Invoiless for your business can yield numerous advantages:

- Time-Saving:

The platform simplifies invoicing tasks, freeing time for core business activities. - Faster Payments:

Automation and real-time reminders encourage quicker payment from clients. - Professional Branding:

Customizable templates ensure that invoices align with your brand identity, enhancing professionalism. - Centralized Management:

Users can manage invoices, payments, and client communications in one place. - Cost-Effective:

Affordable pricing makes it an excellent choice for startups and small businesses.

Real-World Example

Freelancers often struggle to track unpaid invoices. With Invoiless, payment statuses are visible on the dashboard, and automatic reminders reduce overdue payments significantly.

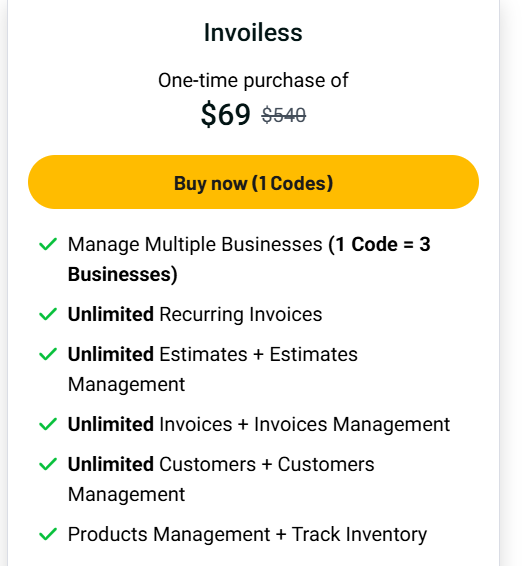

Pricing Details

Invoiless offers pricing plans tailored to different needs:

- Free Plan:

Perfect for exploring the platform’s capabilities. - Monthly Subscription:

Provides access to advanced features on a flexible monthly basis. - Annual Subscription:

Offers premium features at discounted rates for long-term users.

The pricing structure ensures affordability without compromising on essential features. Invoiless lifetime price $69.

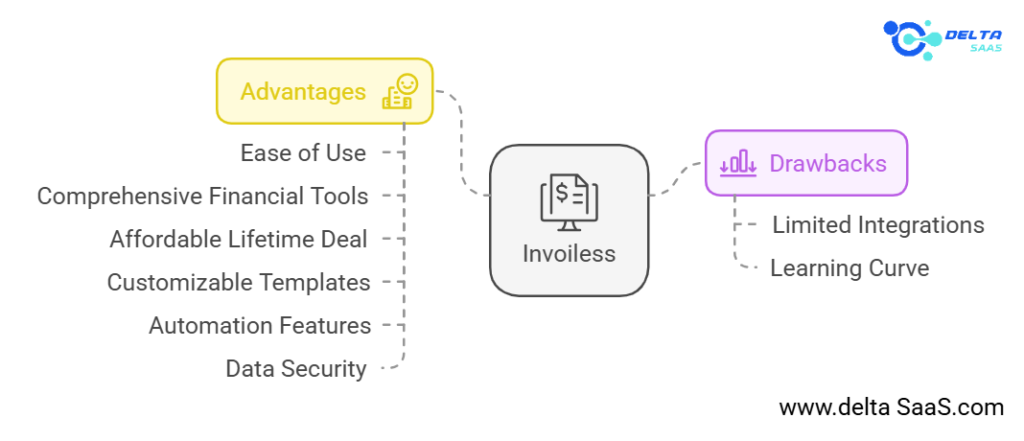

Drawbacks to Consider

Though Invoiless is a powerful platform, there are minor drawbacks:

- Limited Customization Options

Some users have noted fewer advanced design options for invoice templates. - Delayed Support Responses

On rare occasions, users report delays in receiving support responses during high-demand periods.

These issues are generally outweighed by the platform’s strengths, making it a reliable choice for many users.

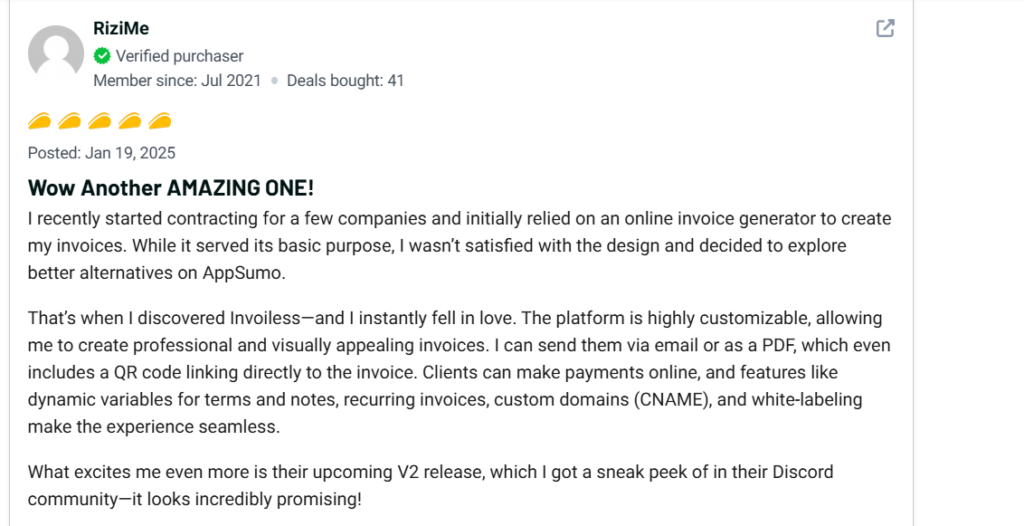

User Reviews

Invoiless receives consistently positive feedback for its ease of use and robust features.

- Ease of Use:

“The dashboard is intuitive, making invoicing simple even for non-accountants.” - Customer Support:

“Support was responsive and resolved my query in under 24 hours!” - Feature Set:

“The API integration is a game-changer for our ERP system.”

Most reviews highlight the platform’s efficiency and reliability, proving its value for small businesses and freelancers.

How Invoiless Compares to Competitors

When choosing an invoicing tool, it’s crucial to understand how Invoiless compares to popular platforms like QuickBooks, Xero, and Sage.

QuickBooks vs. Invoiless

QuickBooks is a robust accounting solution offering extensive bookkeeping features. While it excels in general ledger and payroll management, its interface can be overwhelming for users who only need invoicing tools.

Why Choose Invoiless?

- More straightforward interface tailored for invoicing.

- It is more affordable for small businesses and freelancers.

- Faster invoice generation for users without accounting knowledge.

Xero vs. Invoiless

Xero combines invoicing with accounting, payroll, and tax features, making it an excellent choice for larger enterprises. However, its complexity may not suit small business owners.

Why Choose Invoiless?

- Dedicated focus on invoicing for small businesses.

- Quick setup without extensive onboarding.

- Lower cost for startups and independent contractors.

Sage vs. Invoiless

Sage is designed for businesses that need ERP and CRM solutions in addition to accounting. While powerful, it can often feel bloated for those focused primarily on invoicing.

Why Choose Invoiless?

- Lightweight platform designed for faster invoice processing.

- There is no need to invest in features you won’t use.

- A straightforward system without steep learning curves.

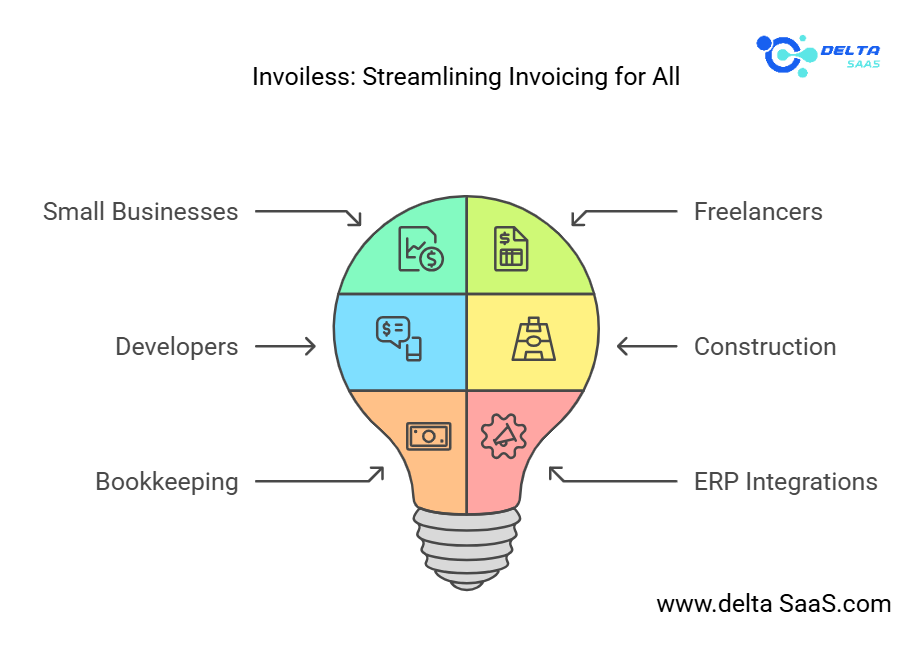

Industries Benefiting from Invoiless

Invoiless is versatile, catering to a range of industries with specific needs:

Freelancers and Consultants

Freelancers often manage multiple clients with unique payment terms. Invoiless simplifies this by:

- Providing professional templates.

- Automating payment reminders.

- Supporting multi-currency transactions for global clients.

Construction Businesses

Construction firms deal with high-value invoices and phased payments. Invoiless:

- Tracks partial payments efficiently.

- Offers detailed balance sheets for better financial oversight.

Small and Medium Enterprises (SMEs)

SMEs require tools that are affordable yet feature-rich. Invoiless fits perfectly by:

- Integrating with existing accounting software like QuickBooks.

- Keeping costs low with free and flexible paid plans.

Invoiless for Accounting Professionals

While Invoiless isn’t a full-fledged accounting software, it complements accounting practices by handling the invoicing cycle effectively.

- Accountants can integrate it with platforms like SAP or Intuit QuickBooks for seamless workflow.

- Bookkeepers can rely on it to maintain an error-free invoicing system for clients.

- Tax Preparers benefit from organized records and detailed templates for easy tax filing.

Why Invoiless Excels for Small Businesses

Small business owners often face limited budgets and a lack of accounting expertise. Invoiless bridges these gaps by providing the following:

- Affordable Pricing: Plans that don’t strain finances.

- Time-Saving Automation: Automates repetitive tasks like follow-ups and payment tracking.

- Aesthetic Invoices: Clean, visually appealing designs that leave a positive impression on clients.

Example Case Study:

Using Invoiless’s automated reminders, a small graphic design firm reduced its payment delays by 50%, improving its cash flow within three months.

The Role of Automation in Invoiless

Automation is a standout feature in Invoiless, helping businesses eliminate repetitive tasks:

- Recurring Invoices: Automatically sends invoices for ongoing projects or subscription services.

- Payment Tracking: Sends reminders to clients without manual intervention.

- Data Sync: Synchronizes payment data with other accounting tools like Excel or QuickBooks.

This focus on automation ensures businesses can save time and minimize errors.

Also Read

Sterling Stock Picker Reviews: Stock Insights

Tykr Reviews: Smarter Investment Decisions

Camelo Reviews: Simplifying Work Schedules and Employee Management

Final Thoughts: Why Choose Invoiless?

Invoiless is a practical choice for small business owners, freelancers, and SMEs seeking an efficient, user-friendly invoicing platform. Its affordability, automation features, and customization options make it an appealing solution for managing invoices without requiring extensive accounting expertise.

While there are minor limitations, such as template customization and occasional support delays, the platform excels in usability, time savings, and professionalism. By integrating seamlessly with tools like QuickBooks and Xero, Invoiless enhances overall financial management.

If you need an intuitive invoicing tool to streamline your workflow and boost cash flow, Invoiless is worth exploring.

Frequently Asked Questions

What is Invoiless?

Invoiless is an all-in-one invoicing platform designed for freelancers, small businesses, and SMEs to create, send, and manage invoices efficiently.

How does Invoiless help small businesses?

It automates tasks such as invoice generation, payment tracking, and reminders, saving time and improving small businesses’ cash flow.

Is Invoiless suitable for accountants?

Yes, accountants can use Invoiless to streamline invoicing and integrate it with tools like QuickBooks or SAP for comprehensive financial management.

Does Invoiless support multiple payment options?

It supports payments via credit cards, PayPal, and bank transfers, making it convenient for clients worldwide.

Is there a free version of Invoiless?

Yes, Invoiless offers a free plan for users to explore its basic features before committing to a paid subscription.

What industries benefit the most from Invoiless?

The platform’s tailored features and affordability greatly benefit freelancers, construction businesses, and small—to medium-sized enterprises.

Can I customize invoices in Invoiless?

Yes, Invoiless provides professional templates that can be customized with logos, branding, and payment terms.

Does Invoiless integrate with other accounting software?

Invoiless integrates with tools like QuickBooks, Xero, and Excel to streamline financial workflows.

What sets Invoiless apart from competitors?

Its simplicity, affordability, and automation features make it ideal for businesses that primarily handle invoicing without needing extensive accounting functions.

Does Invoiless offer mobile access?

Yes, Invoiless will soon release iOS and Android apps, enabling users to manage invoices on the go.